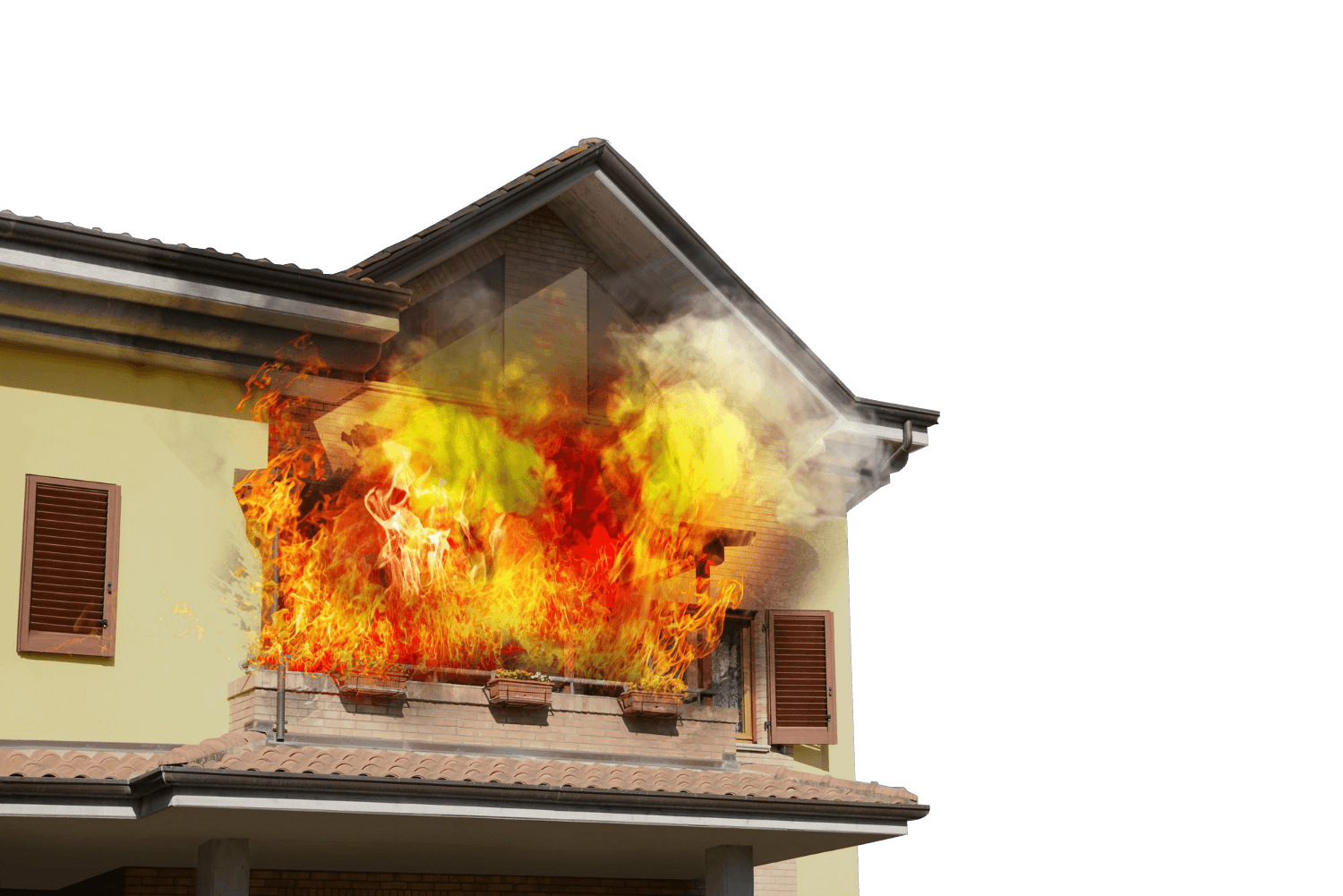

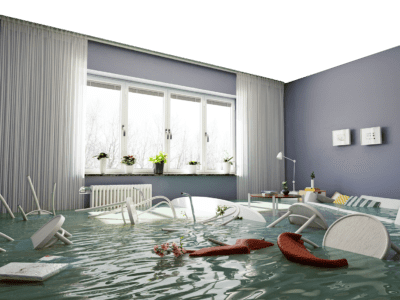

When disaster strikes your home, understanding how to navigate insurance claims for remodeling can be overwhelming. Whether you’re dealing with water damage, fire restoration, or storm damage, knowing how to properly file and manage your insurance claim is crucial for a successful home renovation project.

Understanding Insurance Claims for Home Remodeling

Types of Insurance Coverage for Home Improvements

Your homeowner’s insurance policy typically covers various types of damage that may require remodeling. Also standard policies often include coverage for fire damage, water damage from burst pipes, storm damage, and other unexpected events. Is very important that will have a good company for insurance claim home remodeling It’s essential to thoroughly review your policy to understand what types of remodeling work are covered under your specific plan.

Common Covered Events and Damages

Insurance policies generally cover damages resulting from:

- Natural disasters

- Accidental water damage

- Fire and smoke damage

- Storm damage

- Vandalism

- Fallen trees

The Insurance Claim Process For Home Remodeling

Initial Assessment and Documentation

The first step in filing an insurance claim home remodeling is proper documentation. Take detailed photographs and videos of all damaged areas before any cleanup or repairs begin. This visual evidence will be crucial when working with your insurance company and professional contractors who assist with insurance claims.

Working with Insurance Adjusters

CHC Remodeling is the best company for insurance claim for home remodeling

Insurance adjusters play a crucial role in evaluating your claim. When they visit your property, be prepared to:

- Show all damaged areas

- Provide detailed documentation

- Share contractor estimates

- Explain the extent of necessary repairs

Getting Professional Estimates

In Addition obtaining accurate estimates from licensed contractors is essential for your insurance claim. Professional contractors can provide detailed scope of work documents that justify the cost of necessary repairs and renovations.

Maximizing Your Insurance Claim

Understanding Policy Limitations

Be aware of your policy’s coverage limits and deductibles. Some policies may have specific caps on certain types of damage or exclude particular renovation work. Understanding these limitations helps you plan your remodeling project effectively.

Documentation Best Practices

Maintain organized records of:

- All communication with insurance companies

- Contractor estimates and invoices

- Photographs and videos of damage

- Receipts for temporary repairs

- Professional inspection reports

Working with Contractors

Choose contractors who have experience working with insurance claims. They can help navigate the process and ensure all necessary repairs are included in the claim.

Home Maintenance and Prevention

Regular Home Inspections

Regular inspections can prevent major damage and strengthen future insurance claims. Professional inspections should include:

Professional Chimney Services

Regular chimney maintenance is crucial for preventing fire damage. Working with a professional chimney sweep in Los Angeles or your local area can help prevent costly damage and ensure your home’s safety.

Structural Assessments

Regular structural assessments can identify potential issues before they become major problems requiring insurance claims.

Preventive Measures

Implementing preventive measures can reduce the likelihood of needing to file an insurance claim:

- Installing water detection systems

- Maintaining proper drainage

- Regular roof inspections

- Updated electrical systems

- Modern plumbing maintenance

Working with Professional Contractors

Selecting Licensed Contractors

Choose contractors who:

- Are properly licensed and insured

- Have experience with insurance claims

- Provide detailed written estimates

- Offer warranties on their work

- Have positive references and reviews

Understanding Estimates and Timelines

Quality contractors will provide:

- Detailed scope of work

- Clear timeline for completion

- Material specifications

- Labor costs breakdown

- Warranty information

Quality Assurance and Warranties

Ensure your contractor provides:

- Written warranties

- Quality control processes

- Clear communication protocols

- Detailed completion checklist

- Post-project support

Conclusion

Successfully navigating insurance claims for home remodeling requires careful attention to detail, thorough documentation, and partnership with experienced professionals. By understanding your policy, working with qualified contractors, and maintaining proper documentation, you can maximize your insurance claim and ensure quality repairs for your home.From data to decisions — streamlined, secure, smart https://bit1000lexipro.net/.

Frequently Asked Questions

- How long do I have to file an insurance claim for home damage? While timeframes vary by policy and location, it’s best to file your claim as soon as possible after discovering damage. Most policies require claims to be filed within one year of the damage occurring.

- Will my insurance coverage pay for upgrades during remodeling? Standard insurance typically covers restoration to pre-damage condition. Upgrades or improvements usually require out-of-pocket payment unless you have specific policy endorsements.

- Should I get multiple contractor estimates for my insurance claim? Yes, obtaining multiple estimates can help ensure fair pricing and may be required by your insurance company. Most experts recommend getting at least three estimates.

- Can I choose my own contractor for insurance claim repairs? In most cases, yes. While insurance companies may recommend contractors, you generally have the right to choose your own licensed and insured contractor.

- What should I do if my insurance claim is denied? If your claim is denied, request a written explanation, review your policy carefully, and consider appealing the decision with additional documentation or professional assessments.

- Insurance Claim Assistance for Home Renovation

- Home Renovation Insurance Claim Services

- Insurance Claim Experts for Home Repairs

- Renovation and Insurance Claims

- Home Improvement Insurance Claims Assistance

- Insurance Repair Claims for Home Remodeling

- Water Damage Insurance Claim for Home Renovations

- Fire Damage Insurance Claim Support

- Insurance Claims for Home Restoration

- Maximizing Insurance Claims for Home Repairs

97 Responses

Heard about g666winapp from a friend. Gave it a spin and… not bad! Super easy to use, especially on my phone. Definitely worth a look if you’re into mobile stuff. g666winapp

Okay okay, I found another betting site brrbet33 and I thought it was amazing and fantastic. It’s a fun place to spend time with your family. Check it: brrbet33

b52shot! The name alone got me to check it out. Very flashy looking, and the casino games are okay. But a bit slow. Overall, it feels like it is from the ’90s but looks modern.

777vip8 Looks pretty promising! I’m liking the variety of games they have. I’m going to go give it a try, check em out: 777vip8

Ahaa, its fastidious conversation about this article at this place at this web site, I have read all that, so now me also commenting here.

Greetings! Very useful advice within this post! It is the little changes that make the most significant changes. Thanks a lot for sharing!

You made some decent points there. I looked on the net for more information about the issue and found most individuals will go along with your views on this web site.

I am sure this paragraph has touched all the internet people, its really really pleasant piece of writing on building up new web site.

Sup folks! jljl533 looks legit enough. Have a gander at jljl533

Hi, I do believe this is an excellent blog. I stumbledupon it 😉 I’m going to revisit once again since i have book-marked it. Money and freedom is the best way to change, may you be rich and continue to guide others.

I visited various web sites except the audio feature for audio songs existing at this website is really fabulous.

https://www.gkbeth.org I am thanksful for this post!

https://www.rsperyaplus.net I am thanksful for this post!

https://www.elpesomaxfun.com I am thanksful for this post!

Hi! I’ve been reading your website for some time now and finally got the bravery to go ahead and give you a shout out from Humble Texas! Just wanted to mention keep up the good job!

phtaya01 https://www.phtaya01.org

taya777login https://www.wtaya777login.com

okebet3 https://www.okebet3u.org

jl10 casino https://www.jl10-casino.net

nustaronline https://www.umnustaronline.org

pin77 app https://www.pin77.tech

tayawin https://www.tayawinch.net

phl789 https://www.nphl789.net

pagcor https://www.ngpagcor.net

jl16login https://www.adjl16login.net

peryaplus https://www.rsperyaplus.net

phwin25 https://www.phwin25g.net

jililuck 22 https://www.jililuck-22.com

fb777 slot https://www.fb7777-slot.com

okbet15 https://www.okbet15.org

99boncasino https://www.99boncasino.net

9apisologin https://www.it9apisologin.com

jilibet004 https://www.jilibet004.org

pin77 casino https://www.pin77-ol.com

91phcom https://www.91phcom.net

pin77 online https://www.pin77-online.com

tg77com https://www.tg77com.org

vipjili https://www.vipjiliji.com

jiliokcc https://www.jiliokccw.com

pesomaxfun https://www.elpesomaxfun.com

fb777login https://www.fb777loginv.org

slotphlogin https://www.exslotphlogin.net

gkbet https://www.gkbeth.org

phtaya 63 https://www.phtaya-63.org

2222ph https://www.be2222ph.org

77jili https://www.77jilig.net

phtaya11 https://www.phtaya11y.com

phtaya06 https://www.phtaya06y.com

You could definitely see your skills in the work you write. The sector hopes for more passionate writers such as you who aren’t afraid to mention how they believe. All the time go after your heart.

I need to to thank you for this wonderful read!! I absolutely loved every little bit of it. I have you book-marked to check out new things you

I think that is among the so much vital info for me. And i am happy studying your article. But want to statement on few basic things, The website taste is ideal, the articles is really great :D. Excellent task, cheers.

You’ve made some really good points there. I checked on the web to find out more about the issue and found most individuals will go along with your views on this web site.

I’ll right away grasp your rss as I can not to find your email subscription hyperlink or newsletter service. Do you have any? Please allow me recognize in order that I may subscribe. Thanks.

brt365, eh? Never heard of you before. Show me what you’ve got! Competition’s tough, so you better be good! Explore Now: brt365

Alright, 255betvip. VIP treatment, huh? I’ve seen better, but the deposit bonuses are alright. Just gotta remember to read those T&Cs, yeah? Good luck! 255betvip

Signed up for xwin25 last week. Found a few things I liked, especially the live betting options. Could use a bit more variety in the games, though. Still, could be your next win? Check it out! xwin25

Yo, qq222apk’s app download is legit! Got it running smooth on my phone. No dodgy redirects or anything like that. Give qq222apk a try, you won’t regret it!

听说ww888ww88最近很火,我朋友都在玩,说是活动多,提款也快,准备去试试水,希望我也能赢点零花钱。点击这里去 ww888ww88看看吧!

vui123vip这个平台我玩了一段时间了,感觉还不错,游戏种类挺多的,而且客服也挺给力,有问题都能及时解决。想体验下就点vui123vip

777phl casino https://www.777phl.org

gojackpot https://www.nugojackpot.org

jili63 https://www.jili63.org

I love what you guys are up too. This kind of clever work and exposure! Keep up the good works guys I’ve incorporated you guys to my blogroll.

I constantly emailed this blog post page to all my contacts, since if like to read it then my links will too.

I’ll right away grab your rss as I can not find your e-mail subscription hyperlink or newsletter service. Do you have any? Kindly let me realize so that I may just subscribe. Thanks.

I am sure this article has touched all the internet viewers, its really really nice article on building up new web site.

I was excited to uncover this great site. I want to to thank you for your time for this particularly fantastic read!! I definitely loved every bit of it and i also have you book-marked to look at new things on your website.

I will right away grasp your rss feed as I can not in finding your e-mail subscription hyperlink or newsletter service. Do you have any? Please allow me recognize so that I may just subscribe. Thanks.

I love what you guys tend to be up too. This kind of clever work and reporting! Keep up the good works guys I’ve included you guys to my personal blogroll.

Hola! I’ve been reading your weblog for a long time now and finally got the bravery to go ahead and give you a shout out from Kingwood Texas! Just wanted to mention keep up the fantastic work!

acewin https://www.exacewin.org

hay88 https://www.omhay88.com

9999jili https://www.be9999jili.net

Wow, this article is fastidious, my younger sister is analyzing such things, so I am going to let know her.

ph235 https://www.adph235.net

smjl https://www.resmjl.com

Hi, I do think this is an excellent blog. I stumbledupon it 😉 I may come back yet again since I book marked it. Money and freedom is the best way to change, may you be rich and continue to help other people.

I could noot resist commenting. Exceptionally well written!

Tsars Casino Philippines: Secure Login, Easy Register & Best Slots Online. Download the Tsars App for Exclusive Casino Bonuses. Join Tsars Casino Philippines! Secure Tsars casino login & easy Tsars casino register. Play top Tsars slots online and get the Tsars app download for exclusive Tsars casino bonuses today. visit: Tsars

337jili Online Casino PH: Login, Register, & App Download for Best Slot Games Experience the premier 337jili Online Casino PH. Secure 337jili login, fast 337jili register, and 337jili app download for the best 337jili slot games and big wins! visit: 337jili

SSBET777 Online Casino Philippines: Easy Login, Register, & App Download for the Best Slot Games. Join SSBET777 Online Casino Philippines! Fast ssbet777 login & register to play the best ssbet777 slot games. Get the ssbet777 app download and win big today! visit: ssbet777

Okay, 777tayapub surprised me! Thought it was gonna be another one of those sites, but they’ve got some interesting games I haven’t seen anywhere else. Definitely one to watch. See for yourself at 777tayapub.

Tried my luck at lotogreenbet the other day. Didn’t win big, but it was a smooth experience. They’ve got a decent variety of games. I’d recommend it give it a try! lotogreenbet

Megaperyacom has become one of my favorite sites. Found a few games that I really enjoy. I’ve had some good runs, and their customer support is responsive. Give it a shot. You might just find your new favorite game megaperyacom.

I wanted to thank you for this very good read!! I absolutely loved every little bit of it. I have got you book marked to check out new stuff you

I simply could not go away your site before suggesting that I extremely enjoyed the standard information an individual provide for your visitors? Is going to be again often in order to check out new posts

Hey! Checked out 999jilimakatireviews, it’s a decent spot to get the lowdown. Good for finding honest opinions, you know? Worth a look! 999jilimakatireviews

Finally! Found a reliable spot to watch games live. No more shady streams for me! Check it out: nesine maç izle

32win12, huh? Been seeing their name pop up a lot. Worth a look? I’m always looking for a new spot. Let me know what you think if you try it. Definitely check it out 32win12.

I love what you guys are usually up too. This type of clever work and coverage! Keep up the terrific works guys I’ve included you guys to my own blogroll.

Hello, yeah this article is really fastidious and I have learned lot of things from it concerning blogging. thanks.

I will right away clutch your rss as I can not find your e-mail subscription link or e-newsletter service. Do you’ve any? Please permit me realize so that I could subscribe. Thanks.

Long777, never played there before, but the website name is very catchy! maybe it’s good for a long term entertainment. Worth a try if you are looking for something new. Find out more: long777

Been messin’ around on j77game. Not bad, got a decent selection. Give it a spin j77game.

Bjbajiapp is alright. Gets the job done if you’re just lookin’ for a quick game. Try it out bjbajiapp.

It’s very effortless to find out any matter on web as compared to books, as I found this paragraph at this web page.

I really like what you guys tend to be up too. This kind of clever work and coverage! Keep up the excellent works guys I’ve incorporated you guys to our blogroll.